There are many recent positive data points indicating that enterprise-based Passive Optical LAN (POL) is enjoying accelerated growth in 2019 for commercial and federal government markets – not only in an increase in new customers, but also in the maturity of the POL industry as measured by factors such as:

- Greater Industry Awareness

- Increased Players and Customers

- Industry Trends Driving Growth

Greater Industry Awareness

New technology adoption starts with an awareness of a new idea that offers some improvement to the greater industry. It was over 10 years ago that Verizon launched their Fiber to the Home (FTTH) service called FIOS based on Passive Optical Network (PON) technology. With the success of this residential offering of voice, data and video over a passive fiber infrastructure, Verizon then started to explore adjacent market verticals like downtown high-rise apartment buildings and then came large federal government campus. Once this technology entered businesses, whether they be government or commercial enterprise, it was now serving IT needs of an enterprise Local Area Network (LAN) which is a different proposition then severing residential dwelling units. That meant the PON Optical Line Terminals (OLT) in the enterprise’s main data center and Optical Network Terminals (ONT) at the workers desks, were required to support advanced Ethernet, IP, security, controlled access and Power over Ethernet (PoE) mechanisms.

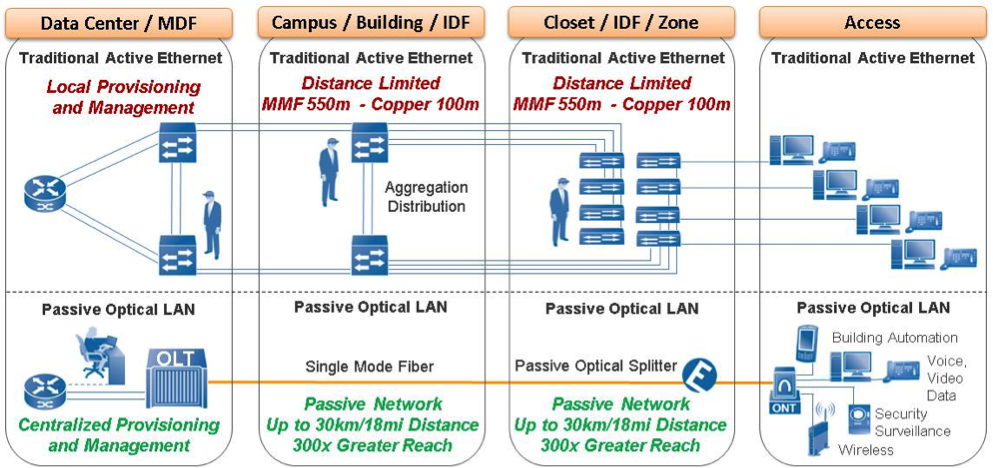

Industry wide awareness of the success of PON, FTTH and Verzion FIOS is well known, while awareness about enterprise Passive Optical Local Area Networks (POL) has been steadily growing over the years [Figure 1].

Figure 1: Comparing the configurations of a Passive Optical LAN to a traditional copper-based active Ethernet LAN

Increased Players and Customers

APOLAN is a non-profit organization composed of manufacturers, distributors, integrators, and consulting companies who are actively involved in the POL marketplace. Since 2014, APOLAN advocates the education and global adoption of passive optical networks for the local area network marketplace around the world. Not only does APOLAN members support the growth and education of the POL industry, but their numbers are growing too. What started with seven founding members 3M, CommScope, Corning, DasanZhone, IBM, Liedos and Tellabs has now grown to approximately 30 active member companies today.

Gartner, a global research and advisory firm providing insights, advice, and tools for leaders in IT, has been actively tracking the market adoption for POL since its inception. Over the years they have published several studies on the topic. In March 2018, Gartner updated their ongoing POL research with a new study titled “Does POL Have a Future in Your Access Network. “ In this paper they sighted a growing number of Gartner client inquiries investigating POL and that the number of network integrators offering POL solution continues to increase. Their position was that POL is a mature technology since it has been deployed by many large service providers for years. They also consider the technology an alternative to the traditional copper-based LANs especially when new cabling infrastructure is required. Finally, Gartner recommend that POL as an option where customer had needed extended Ethernet connectivity, or they experienced talent shortage or when network security was a top concern.

Building Services Research and Information Association (BSRIA) is a research and consultancy organization, providing specialist services in construction and building services. BSRIA tracks new trends in building construction and enterprise workplace design that are driving innovation in enterprise networks inside buildings and across a campus. BSRIA too has been tracking POL adoption over the past couple of years. Their reports highlight how building owners, developers and all IT decision-makers must reprioritize upgrades to the in-building technology backbone infrastructure to make the necessary changes to meet growing connectivity needs. The latest BSRIA global POL study, “Passive Optical Local Area Networks (POL) 2018”, calculated that the POL market is ramping at 46% Compound Annual Growth Rate (CAGR). BSRIA’s growth projection for new POL projects is influenced by the overall maturing of the POL industry – that means a growing number of POL manufacturers and integrators both in North America and globally. “Previous BSRIA’s network cabling market brief cited that POL will experience significant growth, gaining market share and awareness in the LAN market, solidifying its position as a disruptive technology,” said Martin Chiesa, BSRIA senior researcher. “Two years later, we have released the third edition of our POL report and found that POL has evolved faster than our most optimistic expectations.”

Industry Trends Driving Growth

In early summer of 2018, APOLAN conducted a survey of its membership to solicit feedback on what industry trends POL can have the greatest positive impact. The top-3 topics that APOLAN members identified are:

- Wireless network Infrastructure

- Internet of Things (IoT)

- LAN Security

Wireless Network Infrastructure – POL can also be used to wireless backhaul transport of the access points traffic. It can do so in two architectures. First, there is the stand-alone static Wi-Fi architecture with no robust controller functionality. In this scenario, POL can provide the benefits of lower equipment cost, reduced energy and collapsed cabling infrastructure. There are also wireless access point (WAP) features and functionality integration that can be accomplished with POL via the centralized management platform. POL provides a greater system reach for improved performance and coverage for Wi-Fi service. As POL interoperates with established Wi-Fi vendors it allows for Wi-Fi controller functionality to be provided by best of breed Wi-Fi manufactures without limiting the customer’s options. The controller functionality adds dynamic provisioning, interference correction, load balancing and coverage optimization as is required in a true enterprise deployment.

There are also synergies between POL, Distributed Antenna Systems (DAS), Small Cell, future 5G cellular readiness and fiber optic cabling. To be clear, the cellular traffic does necessarily traverse the POL equipment, but it can leverage the same fiber infrastructure that POL utilizes. Alone, indoor enterprise cellular networks have a challenging return-on-investment analysis – it is relatively expensive, it only does one thing and the end customers think they should not have to pay for it. POL has an excellent ROI that can justify the deployment of indoor cellular over existing fiber plant inside buildings and across a campus. One thing is certain, these next-generation enterprise cellular network solutions are not going to be supported on, nor their traffic backhauled over, copper-based CATx cabling. Thus, investments in fiber optic cabling is protected even relative to future demands of indoor enterprise cellular networks advancements.

Internet of Things and Smart Buildings – Today there is a recognized need to design and build an IT network infrastructure that supports thousands of digital services and connectivity. That same LAN also needs to have the flexibility to expand as thousands of additional gigabit Ethernet connections are added over time as the sheer number of digital devices grows exponentially. This is the same problem statement faced IT professionals around the world as they prepare to support the network demands of smart intelligent buildings and the inevitable impact of the IoT. In a traditional IT network design, this rapid connection growth mean racking and stacking Ethernet switches in telecommunication rooms and running point-to-point copper cabling 100 meters to every connected device. Every time you added the complexity of more electronic switches and copper cables you negatively impact energy, thermals, reliability, security and especially environmental green programs. This is not a sustainable business nor sustainable green approach.

POL architecture is a simple, scalable, stable and secure fiber-based IT network architecture that is ideal handle the digital transformation of enterprise business and their buildings. POL network design ensures IT professionals a gracefully and cost effectively means to grow their network connectivity in response to smart building IoT demand by leveraging the Optical LAN system and cabling superior capacity. POL relies on Single Mode Fiber (SMF) cabling from the main data center through the cable risers, through the horizontal pathways and as close to the digital devices as possible. SMF cable bandwidth is tremendous and is measured in terabits today – far greater than copper cables measured capacity in the gigabits. With this inherent capacity, SMF lifespan is expected to exceed 25 years whereas copper cables historically have been ripped and replace every 5-7 years. Similarly, the Optical LAN system and passive optical splitters already provide a graceful migration to 10G, 40G and 100G capacity with no conflicts. Optical LAN has greater gigabit Ethernet density (in smaller footprint) and scalability to support thousands future smart intelligent building (e.g. IoT). Finally, POL has centralized intelligence and management to manage the thousands of IoT connected devices in more M2M and plug-n-play manner.

LAN Security – A secure LAN starts with systemwide centralized intelligence, control, automation and management. Within the POL Element Management Systems (EMS), role-based access for users is established through strict authentication and authorization. This is where secure passwords are assigned and managed. Based on IT staff credentials, privileges are defined for what a user can view and modify. Then the activity of the IT staff can be tracked, which helps root cause analyses during trouble-shooting and can help with junior IT staff training. User management is very important for achieving the highest levels of security, stability and operational efficiencies. The POL EMS is where secure global profiles are created for ONTs, ports, connections and other network elements. Within these secure global profiles consistent policies and procedures can be ensured. Information managed within these global profiles.

The fiber cabling infrastructure can make significant contributions to overall security. Fiber optic cabling is more secure than copper cabling. Fiber is not susceptible to interference nor does it introduce interference. With fiber you have no cross-talk, no EMI, no RFI and no EMP. The opposite is true of copper cabling, which allows radiate emissions that can be eavesdropped without physical access.

The POL ONTs are inherently secure as well. Optical LAN ONTs are designed with no local management access. This is done because there are few needs for human touches at the ONTs. The ONTs are basically simple optical-to-electrical terminals. ONTs are highly secure and reliable, which ultimately helps improve security. Furthermore, Optical LAN has centralized intelligence and management; no information is stored at the ONTs. That is, user and provisioning information does not reside on ONT.

Passive Optical LAN Market Poised for Expansion

Taking into consideration these key data indicate an accelerating use of fiber-based infrastructure in enterprise LANs – perhaps POL has hit a point of inflection. Whether it be greater awareness, increased players, growing customers both in North America or globally, POL is experiencing healthy growth this year. These leading industry indicators point towards Passive Optical LAN as a mature and flourishing technology poised for expansion in the future as it directly helps the IT industry overcome challenges with wireless, IoT and security.

If you enjoyed this article and want to receive more valuable industry content like this, click here to sign up for our digital newsletters!

[…] Passive Optical LAN (POL) Growth Accelerates […]